The ‘job to be done’

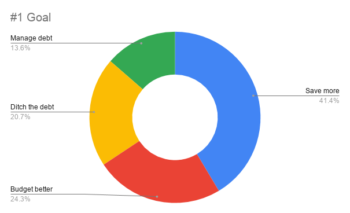

Building systems to make it easier to apply online for credit is a good thing. But it’s only one step in the consumer’s wider ‘job to be done.’ Interviews and surveys with members have helped verify our hypothesis that cutting the cost of credit is only one step in a longer process of improving financial health.

Many credit unions run Save as You Borrow schemes. Members allocate a proportion of their regular repayment to a savings account, so as the loan is repaid the member is building their savings, thereby reducing their need to borrow in the future. These schemes act as nudges members to save regularly. Over time, members save more. Eventually members build a nest egg. If we only built an online loan application system, we’d not be helping members reach their financial goals. It’s not even half-completing their job to be done.

Making it easy to open savings accounts helps people to start saving. But most activity in a credit union takes place in lending. This is where we can make a real difference. People start off borrowing and then turn into savers, through the Save as You Borrow scheme. These schemes can give consumers the necessary nudge to move along to the next ‘job step’, which is to start saving regularly.

Savings build over time. For example, people who have been members of Central Liverpool Credit Union for more than two years have 25% of their loan balance held as savings. When someone has been a member for five years the saving to loan ratio is over 50%. For every £100 borrowed, £50 is held as savings. The credit union is helping members get their job done (to save more and borrow less). The NestEgg app puts the opportunity to save more and borrow less directly into the hands of consumers themselves. This helps reduce bad debt. Members with a savings stake in the credit union are, we estimate, half as likely to default on a loan.

In a recent survey, we found that “building up a safety net to avoid having to borrow for unexpected expenses” was extremely important for members (4.7/5). But people think they can do better. Satisfaction with achieving this goal level was only 3.7/5. But for non-members satisfaction fell considerably. People want to save. Borrowers are keen to make the step to become a saver, but they struggle. However, they are more likely to succeed if they are a credit union member.